We are in Income campaign, That dreaded moment has arrived from which you cannot escape, at least once a year. However, this year 2019, the Rent 2018 It is the first year in which the declarations will not be able to be presented in paper format, for the first time Spain is betting on the internet as the only mechanism to make the Income declaration.

However, there are not few who still have serious problems with this type of mechanism. We are going to teach you how to file the income tax return through the internet easily and quickly so that you do not encounter any difficulties along the way. As always, we bring the best guide for you.

What do I need to file the income tax return online?

There are three possible mechanisms To file the income tax return online, we are going to explain in detail what you need to use each of these methods step by step.

- With electronic certificate or DNIe: Those who already have their electronic certificate have things easier than ever, as you know, the digital certificate is obtained through the FNMT, to obtain it you just have to follow the instructions of THIS LINK, request it through the browser and identify yourself in any of the offices enabled for it throughout the national territory. You can then go back to your device to download the certificate. Too we can use the DNIe if we have a compatible card reader and the security key at hand.

- With Cl @ ave PIN: This is one of the systems most used by most users. To obtain a Cl @ ave PIN we have three possibilities: Through the application for Android or iOS mobile devices (link); Through the mobile phone receiving an SMS if we have the phone registered in the Treasury database; Or by registering in the Cl @ ave PIN program quickly with our telephone number and some of our tax information (link). This is the fastest and most durable if we do not want to go through the ordeal of requesting the digital certificate.

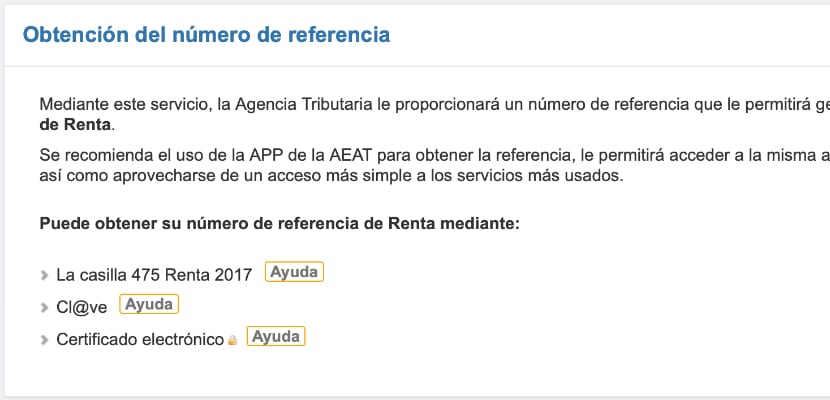

- Through the reference number: The reference number is obtained using the previous year's income data, along with some that may be requested. We can obtain the reference number using box 4745 of the previous year's return through this link or as always, through the Cl @ ave PIN or the digital certificate. Once we obtain it, simply entering the code will allow us to access.

How do I have to make the income statement

To make the income statement we must go to the Electronic Headquarters of the Tax Agency. To do this, simply enter: www.agenciatributaria.es and click on the «Rent» icon of the shortcuts, or from the Electronic Office within the section of Featured Campaigns, where we will find the corresponding income campaign.

Of all the procedures that it allows us to carry out, the one that we are going to select if what we want is to make the income statement because we already have all the data we need to do so is: Draft / Declaration processing service (Income WEB).

When we click on this it will ask us we identify through any of the three possible methods and we will go to the window of Rental Services. Of all the possible options we have to choose the one of Draft / Declaration (WEB Income) and we will automatically open the data entry system for the income statement, from now on you will simply have to continue filling in the appropriate data and making sure that they are correct in the proposed draft.

When we're done with it click on the upper right corner in the section «Statement summary » and then click on "Submit statement" if we are satisfied with the result.

How to consult the tax data of the Income

Checking the tax data to make the income statement is extremely easy, the first thing we must do is enter THIS LINK, then we will choose the option "Check your tax details" within the section of fiscal procedures. Now it will ask us again to identify ourselves with any of the three enabled methods that we have explained at the beginning of the guide.

Then a relationship will be shown in the form of a table showing what our tax data are, both in reference to income from work and those that have been accrued as a result of economic or professional activities. It is important to always write down and take into account these tax data to check in the summary of the income statement that they have been correctly informed in it and therefore we are not omitting any type of information in our declaration.

2018 Income Guide

These are some questions and answers Quick information about the Income Declaration of this current year.

- How long do I have to file the 2018 Income? The 2018 Income Tax return can be submitted from April 3 to July 1 of this year.

- Can I go to the Treasury for help? Indeed, you can make an appointment in the section Income 2018> Appointment, until next June 28, 2019. The first appointments are given from May 9, to go to the delegation on the following May 14.

- Can I change the domiciliation of the tax returns? Indeed, through Income 2018> Modify return IBAN account.

- How can I check the status of my income tax return? Very easy, you must enter www.agenciatributaria.es, select Electronic Office, once identified choose the following section: My files> Taxes and fees> Personal Income Tax and there you will be able to see in what state your return is and how long it will take until the return.

This is how easy you can make your income statement through the internet without many complications and making the most of your time. If you have any questions, the comment box is an ideal place to deposit it.